A paycheck stub is an essential document that provides important information about your earnings and deductions. It helps you keep track of your income and ensures that you are being paid correctly. However, errors can sometimes occur on paycheck stubs, which can result in discrepancies in your payment. It is crucial to know how to spot these errors and take appropriate action to rectify them. In this article, we will discuss the key steps to identify mistakes on your paycheck stub and the necessary actions you should take.

Review Your Basic Information

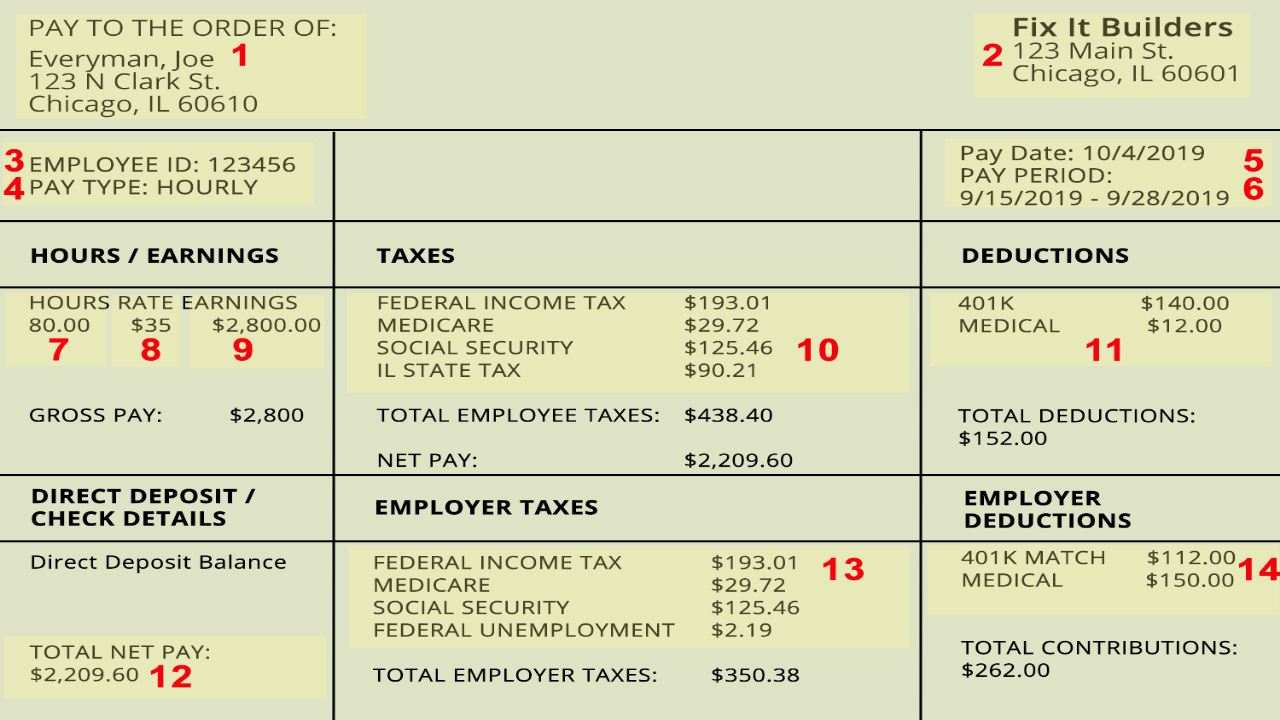

Start by carefully examining the basic information section of your paycheck stub. This includes your name, employee identification number, and contact details. Ensure that all the information is accurate and up to date. Mistakes in these details may cause problems with tax filings or communication regarding your pay. If you notice any inaccuracies, promptly inform your human resources or payroll department to have them corrected. If you are interested in an online check stub maker built by professional accountants, use PayStubCreator – simplify payroll processing!

Verify Earnings and Deductions

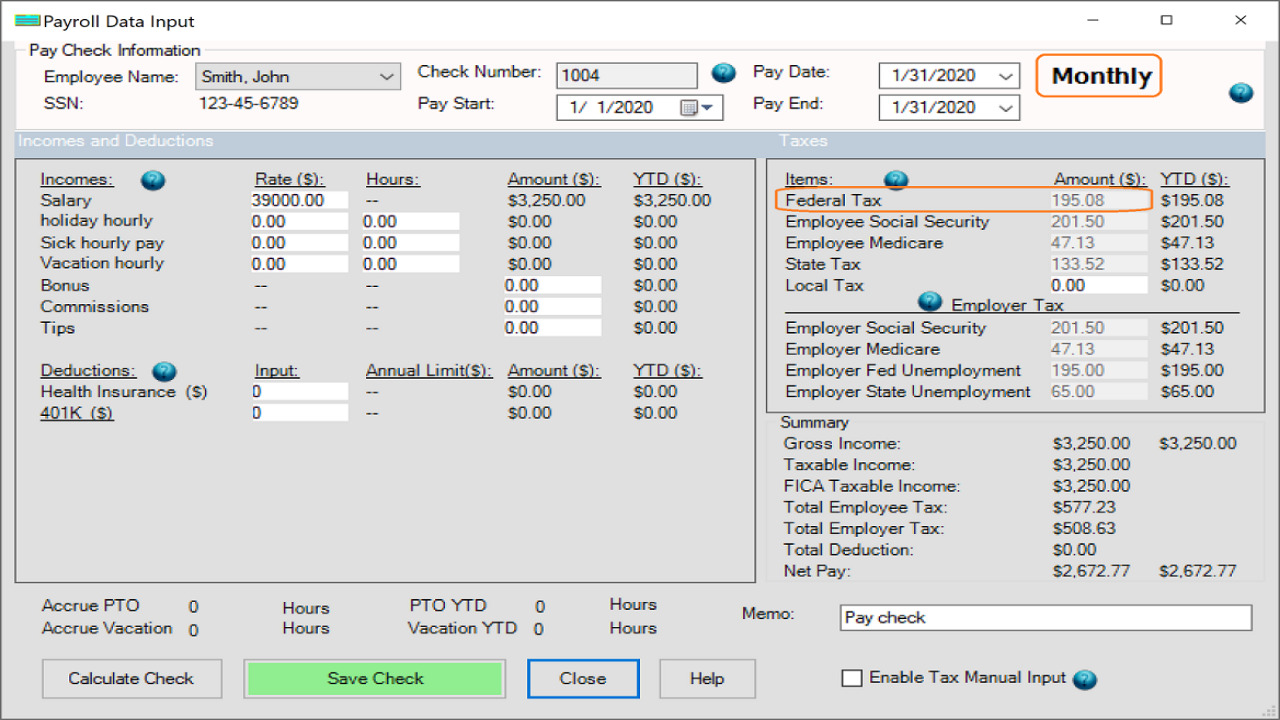

The next step is to review the earnings and deductions section of your paycheck stub. Check that your gross earnings match the agreed-upon salary or hourly rate, accounting for any overtime or bonuses. Additionally, verify that all deductions, such as taxes, insurance premiums, and retirement contributions, are correctly calculated and deducted. If you spot any discrepancies or unfamiliar deductions, consult your payroll department for clarification.

Calculate Taxes Withheld

Taxes play a significant role in determining your net pay. Ensure that the federal, state, and local taxes withheld are accurate based on your tax filing status and applicable tax rates. Mistakes in tax calculations can result in overpayment or underpayment, impacting your financial planning. If you suspect errors in the tax withholding, request a copy of the payroll tax calculation from your employer or consult a tax professional for guidance.

Track Benefits and Contributions

If you participate in employee benefits programs such as health insurance, retirement plans, or flexible spending accounts, review the corresponding sections of your paycheck stub. Verify that your contributions align with the agreed-upon amounts, and ensure that the benefits you enrolled in are accurately reflected. If you notice any discrepancies, contact your human resources department or benefits provider for clarification and resolution.

Analyze Time and Attendance

For hourly employees, it is crucial to cross-check the hours worked and any overtime or shift differentials listed on your paycheck stub. Ensure that the recorded hours accurately reflect your actual working hours. Additionally, verify that any overtime pay or other additional earnings are correctly calculated. If you identify any inconsistencies, report them to your supervisor or timekeeping department to rectify the issue.

Take Action Promptly

Upon identifying errors on your paycheck stub, it is essential to take prompt action. Start by documenting the discrepancies, including dates, amounts, and any supporting evidence. Notify your employer’s payroll or human resources department immediately to initiate the correction process. Most organizations have a designated procedure for resolving paycheck errors. Follow up with them regularly until the issue is resolved, and confirm that the necessary adjustments have been made on subsequent paycheck stubs.

In conclusion, monitoring and verifying your paycheck stub regularly is crucial to ensure accurate payment and financial stability. By carefully reviewing the basic information, earnings, deductions, taxes, benefits, and time records, you can spot errors and take appropriate action to rectify them. Promptly reporting any discrepancies to your employer’s payroll or human resources department will help in resolving the issues efficiently. Remember, staying vigilant about your paycheck stub will protect your financial interests and promote a healthy working relationship with your employer.